flow-through entity tax form

A fiduciary member of an electing PTE must add back to income the amount of the credit received for the tax paid by the electing pass-through entity. Entities can use Web Pay to pay for free and to ensure the payment is timely credited to their account.

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

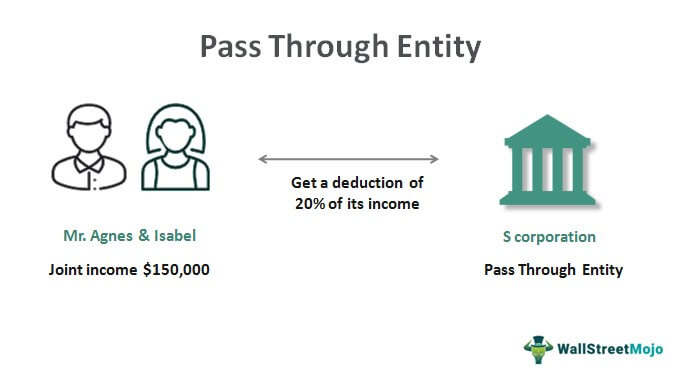

A pass-through entity also known as a flow-through entity is not a particular business structure but a tax status enjoyed by any business that does not pay corporate tax.

. Select the Services menu in the upper-left corner of the Account Summary homepage. Once the payment is made the payment will remain as a PTE elective tax until a tax return. This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has.

In December 2021 Michigan amended the Income Tax Act to enact a flow-through entity tax. Eligible pass-through entities must register for the 63D-ELT tax type before making a payment. Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

Gretchen Whitmer signed legislation on Dec. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan. The Michigan Flow-through Entity Tax is administered under the provisions of the Revenue Act which permits a compromise of interest or penalties or both.

On Line 1 of Form 504. Finally due to the nature of this retroactive application to 2021 tax situations quarterly estimated payments of tax otherwise due for tax year beginning in 2021 will not accrue any penalty or interest. Flow-Through Entity Tax Payments Due by March 15 2022 To Create a Member Income Tax Credit for Tax Year 2021.

Retroactive to tax years beginning on or after Jan1 2021 the law allows eligible entities to make a valid election and file and pay tax at the entity level giving a deduction against entity taxable income. October 2021 Department of the Treasury Internal Revenue Service. Entities can also use the Pass-Through Entity Elective Tax Payment Voucher FTB 3893 to make a PTE elective tax payment by printing the voucher from FTBs website and mailing it to FTB.

Due to the unique combination of factors related to the implementation of the tax including its enactment late in 2021 its retroactive application effective January 1 2021 and its immediate estimated tax. Quarterly estimated entity flow-through tax payments will be required in 2022 if entity level. The majority of businesses are pass-through entities.

With flow-through entities the income is taxed only at the owners individual tax rate for ordinary income. Do not make 63D-ELT payments on other pre-existing tax types. The new flow-through entity tax will allow business owners to once again deduct their Michigan income taxes related to flow.

Flow-through Entity Tax Quarterly Estimated Tax Payments for Tax Years Beginning in 2021 Not Subject to Penalty or Interest. For cash basis taxpayers entity level tax payments must have been made by December 31 2021 to deduct such taxes on their individual federal tax return 1040 in 2021 payments made after that date will be deductible on the 2022 individual federal tax return. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity.

PTEs and their owners should take these taxes into account when determining the impacts at the entity and owner levels. The pass-through entity must file its annual return and make the election before filing the 2021 Form 63D-ELT. It allows ownersshareholders to receive higher net returns on their investment.

On December 22 Michigan enacted a flow-through entity tax as a workaround to the state and local tax limitations on individuals from the Tax Cuts and Jobs Act. There are two major reasons why owners choose a flow-through entity. The information in this section also applies if for the 1994 tax year you filed Form T664 Election to.

A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. Instructions for Electing Into and Paying the Flow-Through Entity Tax. The PTE tax rate is equal to 495 percent 0495 of the.

Owners can claim a refundable tax credit against the flow-through income providing. Governor Whitmer signed HB. 20 2021 to provide an elective flow-through entity FTE tax.

On the Form Selection page choose Request for six-month extension to file the pass-through entity tax. 1 As a result Michigan is the latest state to enact an entity-level tax regime as a workaround to the federal 10000 state and local tax SALT deduction limitation adopted under the Tax Cuts and Jobs Act TCJA of 2017. Calendar year 2021 has continued the trend of pass-through entity PTE tax proposals.

In this legal entity income flows through to the owners of the entity or investors as the case may be. If the entity does not have a Business Online Services account the authorized person will need to create one. Each pass-through entity owner reports and pays tax on their share of business income on personal tax Form 1040.

Branches for United States Tax Withholding and Reporting. For tax years beginning on or after January 1 2021 an authorized person can opt in to PTET on behalf of an eligible entity through the entitys Business Online Services account now through October 15 2021. For tax year 2020 only report the addback by entering the total of federal taxable income plus the amounts from 510K-1 Part D Lines 2.

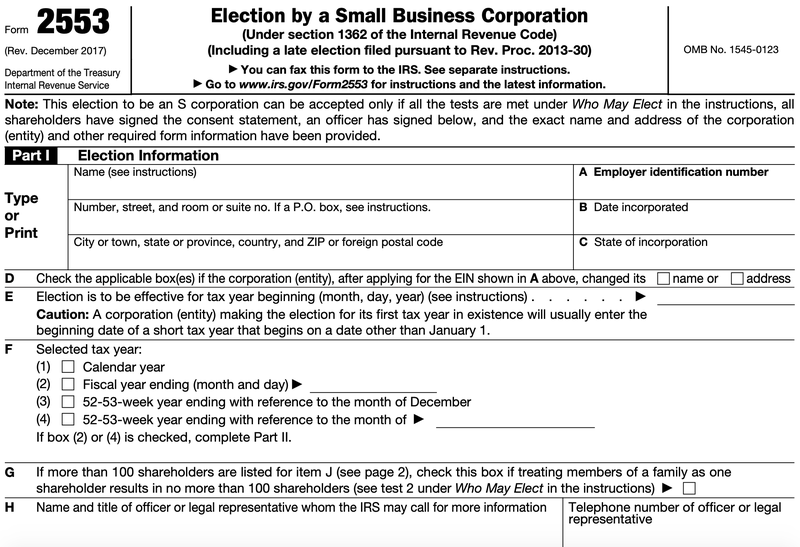

Section references are to the Internal Revenue Code. Select Corporation tax or Partnership tax then choose PTET web file from the expanded menu. T he Pass-through Entity PTE tax is an entity-level income tax that partnerships other than publicly traded partnerships under IRC 7704 and subchapter S corporations may elect to pay effective for tax years ending on or after Dec ember 31 2021 and beginning prior to January 1 2026.

Advantages of a Flow-Through Entity. Common Types of Pass-Through Entities. The entitys income only goes through a single layer of tax rather than two corporate tax and shareholder tax.

Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap February 03 2022 by Bryan Bays. For more information see the MI Website page Flow-Through Entity Tax. If an individual is eligible for a credit for their allocated share of of tax paid by an electing flow-through entity an entry can be made on MI Screen 1 line 29.

LOG IN TO REQUEST EXTENSION. MORE INFORMATION ON MICHIGAN FLOW-THROUGH ENTITY TAX. With the fast approaching state tax compliance deadlines PTEs and their owners are intensifying their attention on these taxes.

The FTE tax and forms are required to be filed online through the Michigan Treasury Online website. Every profit-making business other than a C corporation is a flow-through. Flow-through entities are a common device used to avoid double taxation on earnings.

T 1 215 814 1743. An owners income tax. Hence the income of the entity is the same at the income of the owners or investors.

Fiscal year flow-through entities elected into the tax will pay quarterly estimated tax on due dates determined in accordance with that entitys fiscal year.

Considerations For Filing Composite Tax Returns

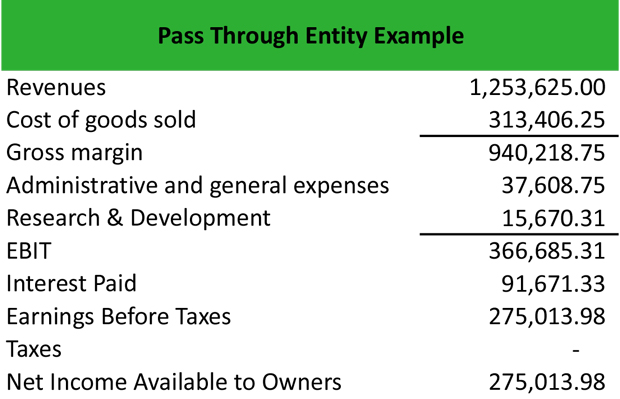

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

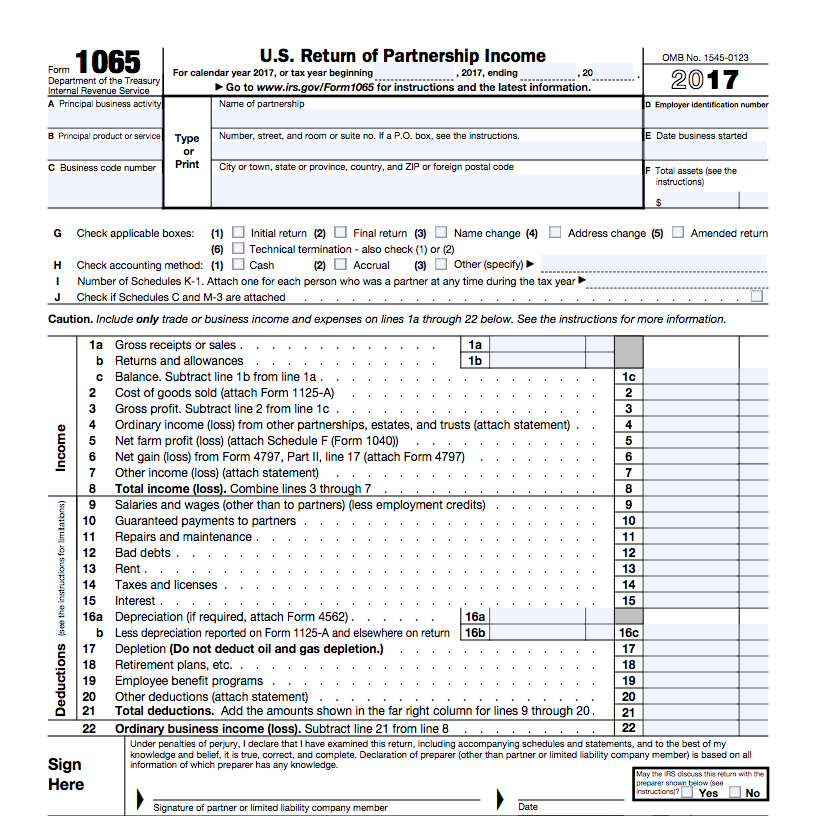

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

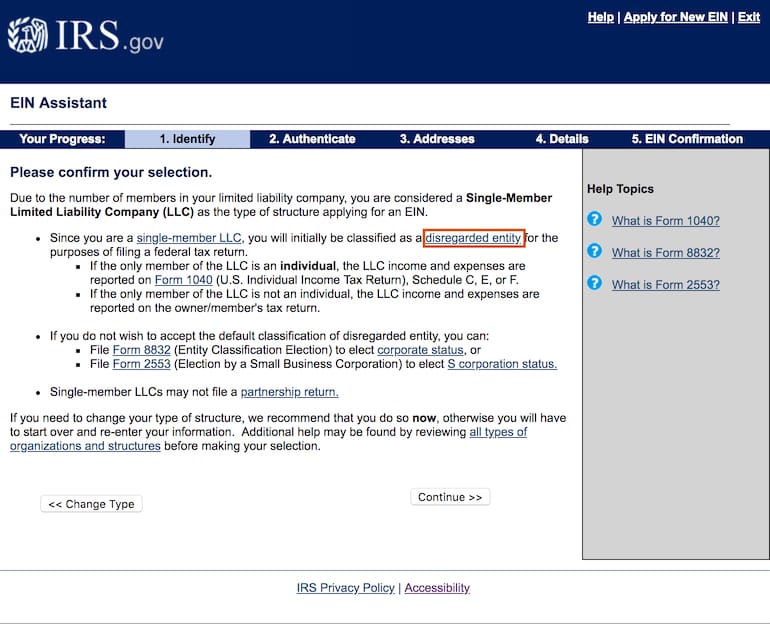

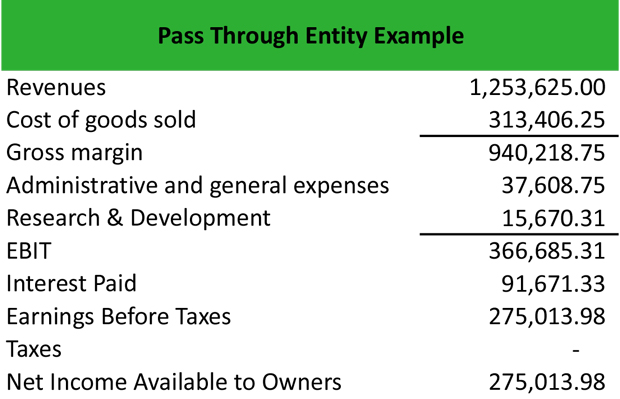

What Is A Pass Through Entity Definition Meaning Example

Pass Through Entity Definition Examples Advantages Disadvantages

/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

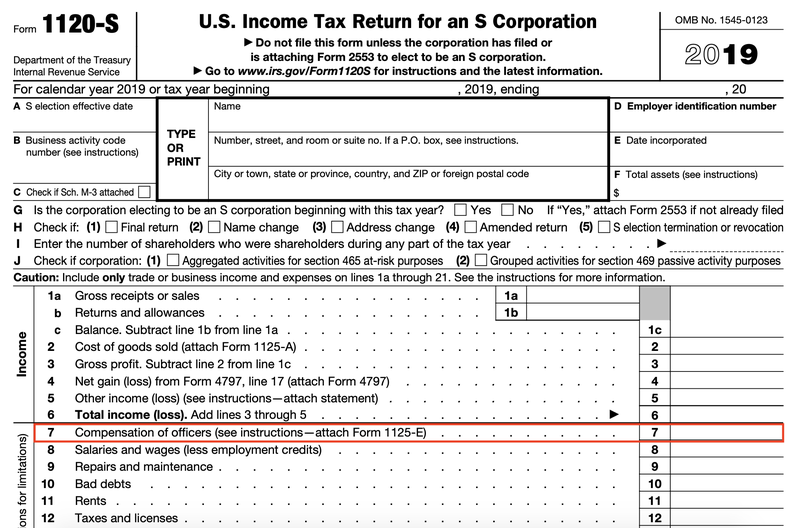

Form 1120 S U S Income Tax Return For An S Corporation Definition

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

A Beginner S Guide To S Corporation Taxes The Blueprint

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Form W8 Instructions Information About Irs Tax Form W8

Nys Pass Through Entity Tax Explained Youtube

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Share Of Income Deductions Credits Etc Definition

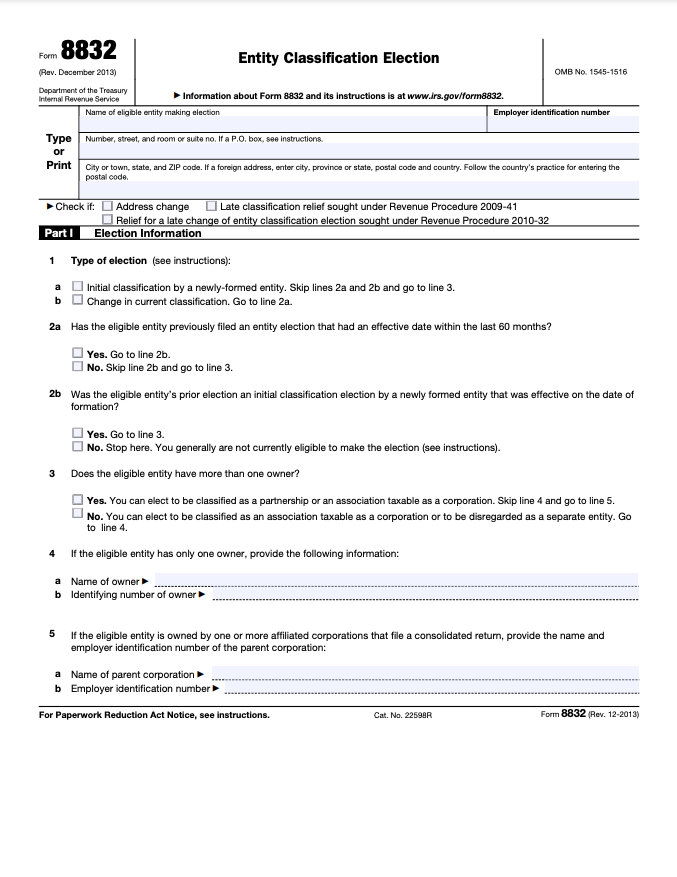

Form 8832 And Changing Your Llc Tax Status Bench Accounting

Pass Through Entity Definition Examples Advantages Disadvantages

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

A Beginner S Guide To Pass Through Entities The Blueprint

The Complete Guide To Llc Taxes Bench Accounting

Hybrid Entities And Reverse Hybrid Entities International Tax Blog